Part 2: A Case For the 401(k)-Retirement Fund

In this three-part series, I will be discussing the 401(k)-retirement fund from my perspective. In part two, I will discuss simulations and impact of compound interest.

In part one, I talked about how tax-advantaged retirement accounts like the 401(k) create advantages for you with the employer match and compound interest. Using plans like these help you save for retirement without thinking about it. Automatically siphoning your money into designated accounts makes saving painless. This is a huge advantage for those of us who are terrible at saving for a rainy day.

We also talked about compound interest. Just like in medicine, it's one thing to understand theory and something different to understand a real-life example. So, let's talk about a real-life example. I'm not a financial advisor, but my co-fellows wanted me to look at their 401(k) options after I kept badgering them about this tax-advantaged retirement account.

Here are the three guidelines I used to find good plans:

Rule #1 – Find a Low Turnover Rate

The turnover rate is exactly what it sounds like. It's an estimate of the number of trades that occur over the course of the year in a given fund. Managers get to make as many or as few trades as they see fit, moving companies in and out of funds, trying to increase the returns on your retirement money. This seems like a good idea until you realize that most managers get paid every time they make a trade whether it benefits your or not. They get to put your money in their pocket each time they trade.

A high turnover rate means that managers are making more trades. More trades means more money coming out of your retirement. A low turnover means managers are making less trades and more money stays in your account.

A good fund manager should be able to give you better returns on your money, beating market returns consistently. Beating the market consistently is very difficult. Some managers may be able to do this for a year or two, but you're most likely a few decades away from retirement. The odds of beating the market 20-30 years in a row? Minuscule.

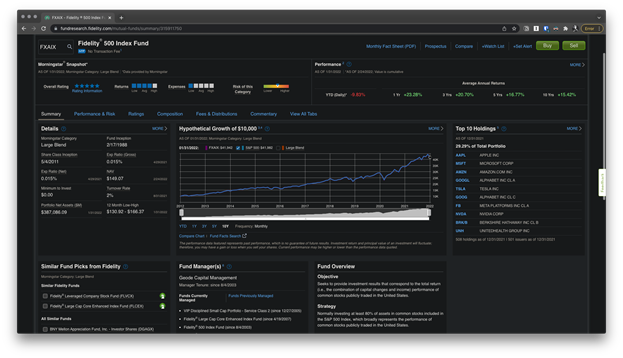

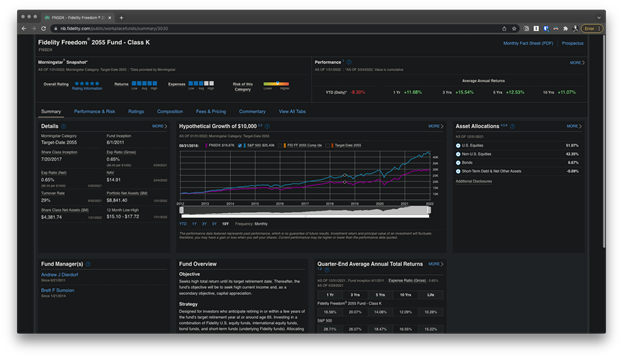

The default fund my co-fellows chose had a turnover rate of 29%. The fund I picked for them had a turnover rate of 2%. The lower turnover rate will leave more money in their retirement account.

Rule #2 – Ignore the 1- to 5-Year Projected Performance (Retirement is Still Far Away)

If you look at the overwhelming amount of information 401(k) plans give you for different funds, there are usually a few projected performance numbers for one year, five years and 10 years. Because most of us have decades to go in the work environment, the one-year projection doesn't matter in the grand scheme of things. These projections are also not guarantees. They are based on past performance of the funds. The past doesn't predict the future, but it's the only information we have to use.

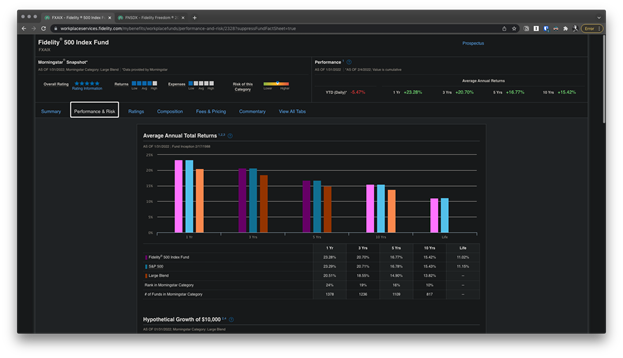

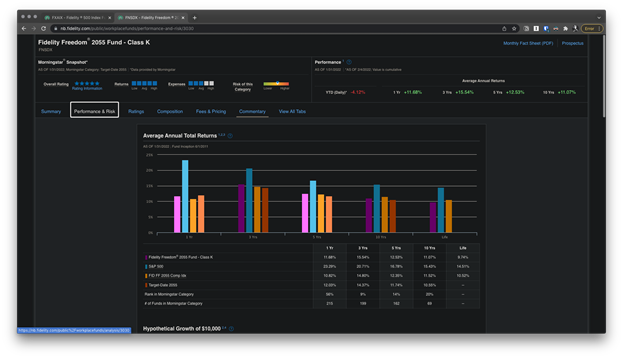

The default options that my friends picked showed a 10-year performance of 11.07%. Not bad. But if you look at the rest of the market, the performance of the default option isn't as good as the rest of the market (S&P 500), 11.07% vs 15.43%. Why lose that 4.36% difference if we don't have to? Remember the power of compound interest!

Over the course of 30 years, this small difference inflates to a difference of hundreds of thousands of dollars.

Rule #3 – Fear the Fees

Fees are insidious. They chip away at your investments and conveniently find their way into the pockets of fund managers. While it's very difficult to find the fees when it comes to the 401(k), the expense ratio gives us a good amount of information.

Small numbers are important. The expense ratios are very small like 0.65% or 0.015%. While it doesn't seem like there's much of a different in these two fractions, the difference is important.

Compound interest works both ways, unfortunately. Fees compound just like gains. Over a 30-year time frame, small differences in fees like 0.65% ($46,153.52) and 0.015% ($2,361) annually amount to a difference of $43,792.29 in total.

Don't be fooled by small numbers, they add up quickly and eat away your retirement funds.

Putting it All Together

In most 401(k) offerings, index funds are available. If you look at the numbers, these funds often beat the other funds that are offered when you look at a 10-year performance metrics. Low fees, better returns, and low turnover give your money more room to grow. And your total will grow more as you put more money into the accounts.

This article was authored by Vybhav Jetty, MD, a fellow at Saint Elizabeth’s Medical Center of Boston. Twitter:@jettymd

This content was developed independently from the content developed for ACC.org. This content was not reviewed by the American College of Cardiology (ACC) for medical accuracy and the content is provided on an "as is" basis. Inclusion on ACC.org does not constitute a guarantee or endorsement by the ACC and ACC makes no warranty that the content is accurate, complete or error-free. The content is not a substitute for personalized medical advice and is not intended to be used as the sole basis for making individualized medical or health-related decisions. Statements or opinions expressed in this content reflect the views of the authors and do not reflect the official policy of ACC.